Service & Solution

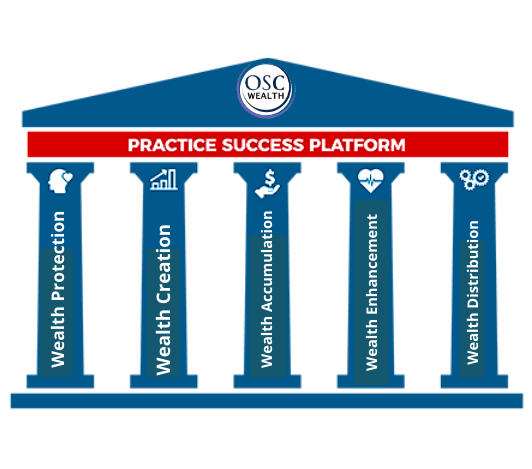

The 5 Pillars of Wealth

It encompasses all aspects of wealth management, so you can rest assured that our financial advice leaves nothing out.

A complete evaluation considers financially detrimental concerns such as Premature death, Disability, Major Disease, Hospitalisation and Health costs, Accidents, Theft and Restoration to damaged Property to ensure that you and your family remain protected should such events occur. Once you have developed a good Protection Plan then go ahead and create a list of realistic Financial Goals.

Next, wealth creation is to maximise your assets’ growth potential. We assist you in developing an investment strategy that is tailored to your specific needs while still growing at the rate you choose. You have a better chance of increasing your investment return with the help of our patented technologies, allowing you to realise your long-term financial goals.

Wealth accumulation is important to ensure that you amass sufficient funds to meet your life goals and plan for retirement. We will assist you in developing a programme that is both realistic and achievable in order to satisfy these requirements.

The fourth Pillar of Wealth maximises the growth potential of your assets. We help you develop an investment program that is appropriate to your unique situation, yet will grow at a rate you desire. With the help of our proprietary tools, you stand a better chance of enhancing your investment return, thereby fulfilling your long term financial dreams.

It is a critical part in your wealth preservation and retention. We’ll work with you to create an effective and efficient estate plan that ensures your legacy is maintained and distributed according to your intentions.

Redeem your Perlindungan Tenang Voucher and get covered with Great Tenang at no additional cost!

- Up to RM42,500 Death or Permanent Disablement coverage due to Accident

- Up to RM50 Hospital Income (per day, up to 30 days)

- Enjoy complimentary COVID-19 coverage

- Up to RM200 Supplementary Cash Relief Allowance

- Up to RM1,000 Bereavement / Funeral Allowance

- Valid till 31/12/2022

Service of OSC Wealth Management

Financial Planning

- Investment Planning

- Children Education Funding

- Estate Planning

- Retirement Planning

- General Insurance Services

- Mortgage & Liability Planning

- Business Succession Planning

- Employee Benefit Schemes

- Islamic Wealth Management Solutions

Service of OSC Wealth Management

Risk management and Insurance Planning

Risk is a fact of life and can have a dramatic impact on your wealth. Risk management is intended to minimize financial and other losses potentially associated with risks to your assets, business, or health.

Part of our job is to protect your financial well-being, and that may require us to help you insulate yourself from certain risks. Everyone should evaluate the possibility of personal, business, and professional liability; property loss; catastrophic illness or disability; and assisted living.

Our team identifies risks that could tremendously impair your financial situation. While it’s important to focus on what may go right with your situation, it’s also crucial to consider how you may be negatively impacted without protections in place. Transferring risk to the deeper pockets of an insurance company in a cost-effective manner may be prudent to minimize the financial damage of a catastrophic, unanticipated event.

Service of OSC Wealth Management

Estate Planning

There are typically three distinct phases:Creation of the Estate – via such entities as business equity, borrowings, investments, and insurance.

Preservation of the Estate – outrunning inflation, reducing taxes, protection of assets from creditors and bankruptcy.

Distribution of the Estate – via wills trusts, business equity, debt / personal guarantee cancellation, capital gains tax, and life insurance.

We work with our client and their legal advisors to ensure that a comprehensive estate planning is in place. Rightful legacy planning is able to ensure your wish could be executed accordingly and minimize tax and compound consequences for your loved one

Will Writing/Wasiat

Cash Trust

Insurance Trust

Hibah

Trust / Waqf Planning

Individual and Business Trust Planning

Service of OSC Wealth Management

Mortgage & Liability Planning

MLTA provide assurance that mortgage borrower need not to worry about the debt as there is any unfortunate happened to one, such as death, disability, and critical illnesses.

It is designed to waive off the outstanding loan and provided subsistence to our beloved family member in the event of death, disability and dread disease

KEY FEATURES AND BENEFITS

Highlights of Mortgage Level Term Assurance:

- Provides level protection for added security on your outstanding loan amount.

- In the event of death or total and permanent disability, your outstanding loan is offset by this plan.

- Financing the insurance premium through a borrowing facility is an option.

Service of OSC Wealth Management

General Insurance Services

- Personal Accident (PA) Coverage

- Property, Fire & Theft Insurance

- Business Insurance

- Vehicle Insurance

- Travel Protection

WE ARE COOPERATE WITH

Your Personal Wealth Planning Journey Made Hassle-free

1. Book a Complimentary Consultation

2. Our wealth advisor will be in touch with you for your needs

3. Propose financial planning that suit your needs

4. Accomplish Your Personal financial goals

Contact

Send a message

Most Asked Question.

- We will call you back to find out more about your aims and requirements

- We'll then organise a telephone consultation for you with one of our experts

- You will be able to ask any questions you have and find out more about investing with Osc Wealth Management Sdn Bhd

Our operating hours are from Monday to Friday, 9.00am to 6.00pm. However, any inquiry outside of our business workings may be left at our “Get In Touch” to contact us, we will respond to you as fast as possible.

Our main office is located at Pj, Kuala Lumpur. However, we provide our services to customers anywhere in Malaysia.

Our operating hours are from Monday to Friday, 9.00am to 6.00pm. However, any inquiry outside of our business workings may be left at our “Get In Touch” to contact us, we will respond to you as fast as possible.

Get In Touch

Please also let us know in ‘Your comments’ which areas are of primary interest to you e. g. Inheritance Tax, pensions, retirement planning or investment planning.